Boba Network: An Optimistic Approach to Ethereum Scaling

Key Insights

The development of Layer-2 scaling solutions is key to improving Ethereum’s scalability and will spur rapid advancements in rollup technology.

Boba Network is an Optimistic rollup built on top of the Ethereum network. It enables lower transaction fees, higher throughput, and increased smart contract capabilities.

Boba Network is powered by the BOBA token, which can be used for governance, staking, and paying gas fees.

Introduction

There is a common misconception that The Merge (Ethereum’s transition to Proof-of-Stake) will be the solution to Ethereum’s high gas fee problem. While The Merge will be a monumental upgrade for Ethereum, gas fees are likely to stay high as users will still be required to pay fees to network validators. Initially, sharding was slated to deploy together with The Merge as the solution for high gas fees. Sharding would have reduced network congestion and gas fees while increasing transaction throughput. However, due to a shift in the roadmap to a rollup-centric Ethereum, sharding is now scheduled to ship sometime in 2023 depending on when The Merge occurs.

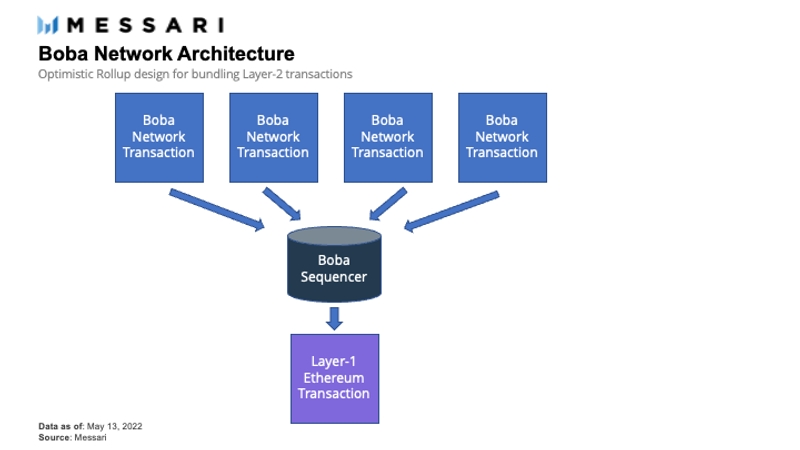

Ethereum scaling solutions bundle hundreds of transactions into a single transaction that is then settled on Layer-1. This bundling distributes the Layer-1 transaction fee amongst everyone in the bundle and can reduce gas fees by up to 100 times. Boba Network follows this approach by providing users with an alternative network to transact on with low fees and high throughput without sacrificing the security of Ethereum. The ecosystem saw attention shift towards Layer-2s in 2021, and this trend should continue as Layer-2s are still early in development and improving rapidly.

Boba Network Overview

Boba Network is a Layer-2 scaling solution on Ethereum that leverages Optimistic rollup technology. It is built and supported by Enya, a decentralized infrastructure solutions company focused on pioneering innovation in the decentralized privacy and software framework fields. Enya has become one of the largest providers of multiparty computation services and is currently serving more than 10 million users across 91 countries.

In 2018, Alan Chiu and Jan Liphardt met at Stanford University and founded Enya. Prior to Enya, Chiu was a partner at XSeed Capital, where he primarily built and invested in enterprise technology startups. Liphardt, on the other hand, has spent the majority of his career as a professor, which included teaching at StartX Accelerator, where he assisted startup companies in the hardware and analytics space.

In May 2021, the testnet launched under the name OMGX. It was later rebranded to Boba Network due to a joint research and development effort between Enya and the OMG Foundation (formerly OMG Network). The OMG Foundation is a non-profit organization dedicated to expanding the Ethereum ecosystem through its ongoing support of the OMG Plasma Network and Boba Network. While Boba Network maintains support from the OMG Foundation, further network development is primarily handled by Enya and the Boba Network DAO.

The Boba Network mainnet officially launched in September 2021 with the goal of reducing transaction and computation fees, increasing throughput, and increasing the capabilities of smart contracts on the Ethereum network.

Architecture

To facilitate this data transfer, a sequencer is needed to order and bundle multiple transactions into a batch on Layer-2 and then submit the batch back to Ethereum via a single transaction. Currently, Boba Network has one sequencer node that is operated by Boba Network, but, in the future, the operator of this sequencer node will be determined by the network’s governance mechanism. These sequencers perform their functions optimistically under the assumption that all transactions are valid, hence the name “Optimistic rollup.” Typically, the network would have a challenge period whereby users can submit a fraud proof to challenge that assumption. If the transaction is invalid, the challenger will be compensated. However, fraud proofs have not been enabled yet as the network remains in development.

The initial Optimism architecture was upgraded with the implementation of a swap-based mechanism. This feature enables users to withdraw funds from Boba Network back to Ethereum in minutes versus the typical seven-day withdrawal period. Instead of waiting for the block finalization process associated with Optimistic rollups, users have the option to use the swap-based mechanism to bypass this delay. This mechanism charges users a small convenience fee which is then distributed to liquidity providers as an incentive.

In March 2022, the Hybrid Compute was deployed to provide functionalities that were previously absent from the network. Hybrid Compute enables the Boba Network smart contracts to easily communicate and interact with all existing non-distributed computer systems (Web2 systems). It acts as a “pipe” between Boba Network’s sequencer and an external source’s API.

Using this pipe is a fairly simple process. A user only needs a smart contract that can make Turing calls and an external server that accepts the calls and returns data in an EVM-compatible format. As a result, smart contracts can call complex algorithms such as machine learning classifiers, interact with real-world data, or sync with the latest state of external servers.

Unlike other Optimistic rollups, Boba Network has cross-chain messaging and a community fraud detector that makes transactions independently verifiable by anyone. Boba Network also implements a different gas pricing logic that updates the Layer-1 security fee price every 10 minutes with smoothing to reduce large price fluctuations. The maximum percentage change from one value to another is capped at 10% of the current gas price per Boba Network’s Price Feed Oracle, which is a fork of Chainlink’s smart contracts. Additionally, Boba Network has developed an NFT bridge that facilitates the bridging of NFTs between Boba Network and Ethereum. However, only specialized NFT contracts are compatible with this bridge (e.g., L2StandardERC721.sol).

BOBA Tokeneconomics

BOBA is Boba Network’s Ethereum-based ERC-20 staking and governance token.

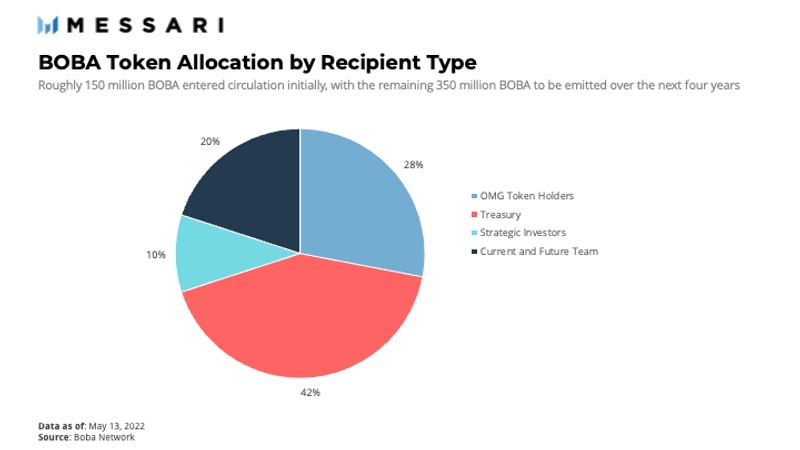

At genesis, 500 million BOBA were pre-mined and allocated to the parties depicted in the graph above, of which roughly 150 million BOBA entered circulation. The initial distribution was primarily the result of the airdrop (140 million BOBA) that allowed holders of the OMG token at the time of the snapshot in November 2021 to claim BOBA on a 1:1 basis.

BOBA primarily functions as the governance token for Boba Network DAO, which is responsible for decisions regarding community initiatives and the future of the network. To participate in governance, holders stake BOBA in exchange for xBOBA and receive one vote for each BOBA that is staked. Currently, stakers also receive BOBA rewards distributed from the Boba treasury. Once the Boba Network fees have stabilized, a portion of each transaction fee earned by the network will be paid to stakers and the emissions from the Boba treasury.

Furthermore, the BOBA tokens from the treasury are used to incentivize network growth. A variety of initiatives are funded with these tokens, including a bug bounty program, liquidity mining rewards, and bridging incentives.

In April 2022, the DAO passed a governance proposal that enabled BOBA to be used as the gas token for the network. While users will still be able to pay gas fees in ETH, using BOBA as the gas token instead will result in a 25% fee discount.

Boba Network Ecosystem

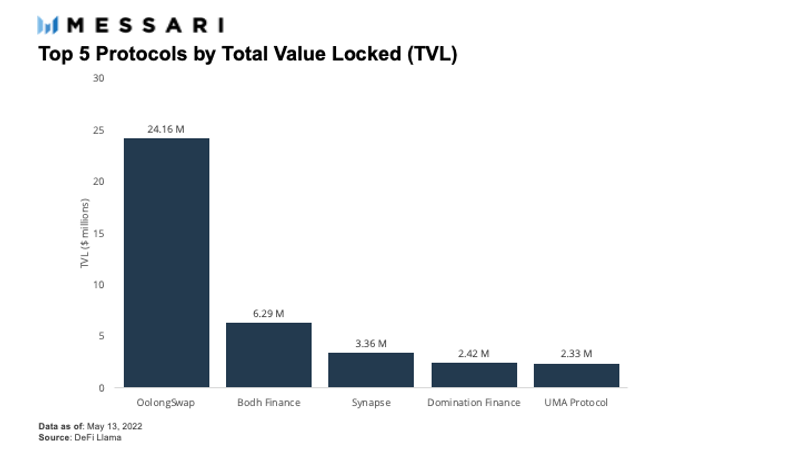

As Boba Network is still in its infancy, it is in the process of attracting new protocols to build on the network. According to Boba Network, 39 projects have either launched or are in development on the network. These include projects such as Synapse, TofuNFT, and Dodo, with the most prominent decentralized application being OolongSwap, the chain’s native DEX. OolongSwap accounts for a majority of the activity on the chain and is responsible for 56% of the total TVL locked in DeFi protocols. Activity on Boba Network is primarily dominated by the top five DeFi protocols in terms of TVL, as shown in the graph above.

To further develop the Boba Network ecosystem, the “WAGMI” incentive program for builders was launched in January 2022 as an innovative alternative to traditional liquidity mining programs. It allows supported projects deployed on Boba Network to incentivize users with “WAGMI Options” (WAGMI tokens). Users can then earn options interacting with these protocols according to the parameters set by the individual protocols. These options are tied to key performance indicators (KPIs) that determine the BOBA payouts based on the performance of Boba Network over one month. For example, if Boba Network’s TVL determines the WAGMI Options, the higher the TVL is during the period, the more the options are worth. Users can then redeem their WAGMI Options for BOBA after a one-month settlement period.

Each month, a new version of the WAGMI program is launched to update the KPI parameters and supported project list. Boba Network collaborated with UMA Protocol, a decentralized financial contracts platform, to facilitate the monitoring of these KPIs. UMA Protocol’s optimistic oracles allow tokens to be locked up in smart contracts and then paid out to users based on the network’s KPIs.

Up Next For Boba Network

Source: Boba Network Discord

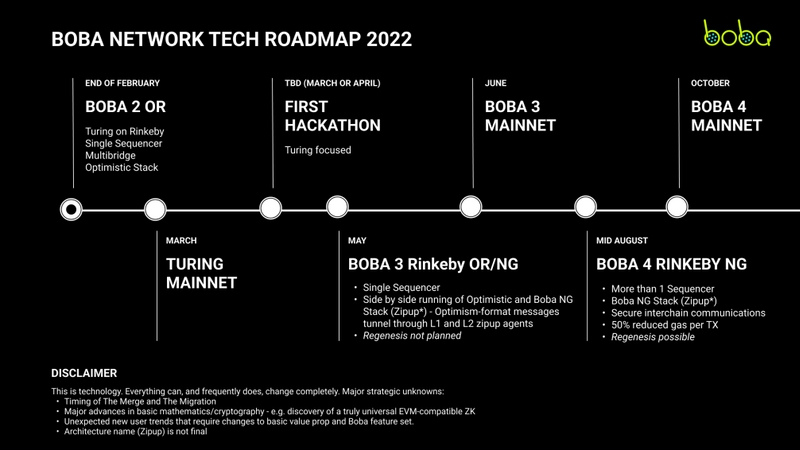

The Boba Network roadmap divides progress into four stages. The current phase is “Boba 2”, which introduced the Hybrid Compute mainnet in March 2022. “Boba 3” is slated to go live on the Rinkeby Testnet in May 2022, with its mainnet planned to launch the following month. The launch of Boba 3 will be the first step toward the network’s transition to an alternative Layer-2 architecture. The network will run two systems (Optimistic rollup and Zipup) side by side to ensure a smooth transition. The systems will run parallel to each other until “Boba 4,” which will transition the network to run solely on the new Zipup system. Boba 4 is expected to launch on the Rinkeby testnet in August 2022, with the mainnet scheduled to launch in October 2022.

The primary goal of this architectural change is to improve security and reduce costs while simultaneously making the network easier to maintain and upgrade. This new system will remain similar to Optimism at the smart contract level; however, its approach to cross-chain communication and bridging will differ significantly.

The timeline of this roadmap is subject to change due to three significant outside factors:

The timing and success of The Merge.

Significant advancements in cryptography.

New user trends that would require a change to the value proposition of Boba Network.

These factors are primarily out of the network’s control but may be necessary for the team to monitor them.

Additionally, at the beginning of June 2022, the team announced a partnership with Moonbeam that will expand the Boba Network to become a multichain execution layer. This partnership will bring Boba Network’s high throughput and Hybrid Compute technology to the Polkadot and Fantom ecosystems.

Competition

In 2021, Layer-2 scaling solutions gained traction as mainnets began deploying in the second half of the year. Technically, Boba Network competes against all of the Layer-2 rollups built on Ethereum, even though the Layer-2s vary in design. Some are intended to serve a specific purpose (e.g., dYdX, Loopring, and Immutable X). Others, like Boba Network, aim to mimic Ethereum and provide all the same functionalities as a Layer-1.

Therefore, Boba Network’s core competitors are universal-purpose Layer-2s. The first is Arbitrum, an Optimistic rollup developed by Offchain Labs that launched its mainnet in August 2021. Since inception, Arbitrum has processed 13.8 million transactions, while Boba Network has processed 0.6 million transactions since its inception (September 2021). As shown in the graph above, Arbitrum currently leads the Layer-2 ecosystem in terms of TVL as it makes up 56% of the total TVL across all Layer-2s.

Arbitrum utilizes a multi-round fraud proof that enables a batch of transactions to be processed with only one state proof. By contrast, Boba Network does not have any fraud proofs implemented yet. While this increases the security of the network, it also extends the delay for users to withdraw funds from the network. Arbitrum has a seven-day withdrawal period, whereas users on Boba Network can withdraw funds back to Ethereum in minutes. Additionally, a major difference between Arbitrum and Boba Network is that Arbitrum currently does not have a token, so ETH is used as the gas fee for all transactions.

Optimism is the other major Optimistic Layer-2 scaling solution that was developed by the Optimism Foundation. It relies on a single-round fraud proof, which makes the fraud proof instant. The tradeoff, however, is that each transaction needs a state root, causing higher costs and increased security risks. Recently, Optimism announced the release of its token, OP, which will act as a governance token and divert a share of the revenue generated by sequencers to holders.

In the future, ZK rollups will be major competitors in the Layer-2 space and are likely to take a significant market share from these Optimistic rollups. Currently, the two most prominent ZK rollups, Starknet and zkSync, are still being developed. Once fully functional, they will also be universal-purpose Layer-2s. These networks will use zero-knowledge-proof (ZKP) algorithms to guarantee that off-chain computing is correct. The ZKPs will greatly increase TPS and reduce the cost of transactions compared to Optimistic rollups. That said, Vitalik Buterin believes ZK rollups will end up superior in the medium to long term but will take “years of refinement and audits for people to be fully comfortable storing their assets in a ZK-rollup running a full EVM.”

Risks

As Boba Network is still being developed, aspects of the system pose a risk to its security. One feature that is yet to be completed is fraud proofs. The absence of fraud proofs enables invalid state roots to be submitted to the system, which can result in funds being stolen.

Additionally, a centralized sequencer can extract maximum extractable value (MEV) if the operator exploits their responsibilities and front runs user transactions. The reliance on a centralized validator also poses a risk if the validator goes down. Downtime may result in frozen funds on the network, and the user would be unable to withdraw the funds back to Layer-1. The funds would be frozen because the withdrawal process requires several days of block finalization and the network will be unable to produce blocks if the validator is down. The swap-based bridging mechanism partially mitigates this risk.

Lastly, the network uses the Optimistic Virtual Machine to execute transactions. This machine increases the risk that funds can be lost, as the implementation is highly complex.

External factors could also potentially alter the future development of the network. The primary one is the timing and success of The Merge. Because the future growth of the Ethereum ecosystem largely depends on the success of The Merge, an unsuccessful merge could significantly alter the roadmap of the network.

Closing Thoughts

Layer-2s will likely bring new entrants to the space that will look to capture a share of the increasingly popular market. With these new entrants comes an increase in competition within the sector, as seen in the new rollups ready for deployment. Since the Layer-2 ecosystem is still early in its development stage, it will likely change rapidly as projects race to develop the best network. This competition is beneficial for the ecosystem because it will force builders to continue innovating and producing high-quality upgrades; otherwise, they risk becoming obsolete.

Optimistic rollups such as Boba Network are currently leading the way in user adoption and activity; however, it is important to note that ZK rollups are still a work in progress. Once functional, there is a possibility that ZK rollups will capture a significant portion of the Layer-2 market from Optimistic rollups. Additionally, the unknown variables such as the success of The Merge could potentially pose unpredictable challenges for these networks. With members of the Ethereum Foundation expecting The Merge to occur in Q3 2022, a pivotal moment for Ethereum’s Layer-2 ecosystem is fast approaching.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Boba, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Last updated