InsurAce: Cover Your Assets

Key Insights

InsurAce offers a unique portfolio-based coverage, reducing cost and saving time.

InsurAce provides DeFi insurance coverage across 20 public chains and 139 protocols.

To date, InsurAce has $327 million in total value covered and $19.6 million in total value locked (TVL).

Multi-Chain Insurance Aggregator, Cover Cancellation Function, and Dynamic Pricing V2 upgrades were added on May 30, 2022.

Traditional insurance offers the general population financial protection from costly and often unpreventable events. In 2020, the total net premium written by the US insurance industry was over $1 trillion. Since the advent of decentralized finance (DeFi), the loss of assets due to vulnerabilities in smart contracts, stablecoin de-pegging events, and custodial risk have been plaguing the crypto industry. According to Chainalysis, $3.2 billion worth of cryptocurrency was compromised in 2021. InsurAce is a multi-chain insurance protocol that offers financial protection against such compromising events. It was built to protect users by offering a multitude of accessible DeFi insurance products.

Background

InsurAce was established by Oliver Xie in September 2020 and is based in Singapore. The InsurAce team is focused on bringing safe, secure, and sustainable insurance solutions to the DeFi ecosystem to improve crypto user confidence and protect users from financial losses. The protocol’s product coverage is deployed on Ethereum, Binance Smart Chain, Polygon, and Avalanche, covering over 120 protocols, 3 centralized exchanges, and 1 IDO platform. InsurAce is a decentralized, multichain insurance protocol built on the Ethereum blockchain.

How It Works

InsurAce incorporates a similar business model to traditional insurance by functioning with two interoperable entities: an insurance arm and an investment arm. Traditional insurance policyholders pay a monthly insurance premium in exchange for protection from losses for coverable events. (e.g. policyholder pays 0.298% for every dollar per month for stablecoin de-peg insurance. If stablecoin moves off-peg, trading below $0.92, the claim will get paid out with evidence and proper documentation)

Insurance companies can sustain this model through pricing and investing. Premiums are priced higher based on the probability of an event occurring, acting as a cushion for the insurer. The insurance premiums received from policyholders can be invested for a return. Insurance companies need to maintain a balance of liquid assets in case of any claims and yield generating assets to help offset those claims.

This traditional insurance framework addresses the shortfalls of most existing DeFi insurance protocols. Unlike its competition, InsurAce introduces robust cross-chain coverage options, eliminates KYC requirements which increases product accessibility, and improves capital efficiency through the use of mining and the investments made by the investment arm.

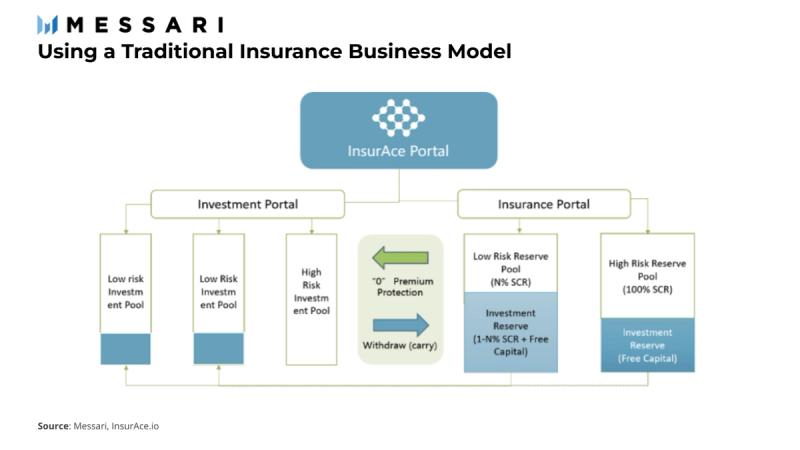

Using a Traditional Insurance Business Model

Insurance Portal (Insurance Arm)

The Insurance Portal generates revenue from collecting insurance premiums and any income generated from investments made using user funds staked in the free capital reserve. Any income generated from these investments are returned to the Insurance Portal to complement insurance premiums and reduce cover cost for users. The insurance arm also provides protection for the investment activities. A percentage of the revenues are used to assist with operational and development costs, community incentives, ecosystem collaborations, and reward all residual gains to its members.

Investment Portal (Investment Arm)

The investment arm (note: still under development) uses the free capital secured from the Solvency Capital Requirement (SCR) to invest in DeFi projects. Investable projects range from yield farming opportunities to staking funds on various decentralized applications. Any income generated from investments is used to cover transactional and operational costs, with the remaining income distribution going to platform users who contributed to the SCR. InsurAce plans on building an investment function that operates similar to Yearn Finance to design and implement effective strategies.

Pricing Model

The pricing models in most DeFi insurance protocols rely on total value staked to determine insurance premium pricing. This methodology largely ignores real protocol level risk and disproportionately estimates insurance premiums for staking pools. InsurAce uses an actuary-based pricing model that assesses risk and expected losses more fairly, optimizing pricing and utilization.

Capital Model

InsurAce adopted a capital model that follows the European Union’s EIOPA Solvency II framework for insurance and reinsurance companies. The solvency requirements provide appropriate incentives to foster robust risk management practices. There are two tiers of capital requirements under Solvency II: the Solvency Capital Requirement (SCR) and Minimum Capital Requirement (MCR). The SCR methodology is the capital management standard used to calculate the minimum required amount of funds to set aside to pay all qualified claims. SCR also ensures the insurance company can meet its obligations over the next 12 months with a probability of at least 99.5%. The MCR sets the threshold at a probability of 85% of adequacy over 12 months.

Product Coverage

Smart Contract Vulnerability coverage safeguards users in the event a covered protocol smart contract gets compromised

Stablecoin De-Peg Risk coverage protects users from any significant stablecoin de-peg event

Custodian Risk coverage varies but protects DeFi users who have assets with custodians and exchanges

IDO Event Risk coverage protects users against the risk of a hacking or cyber attack against the smart contract of an IDO platform

Bundled Cover is a portfolio-based product with the ability to bundle some or all of the product offerings into a single transaction

Platform Architecture

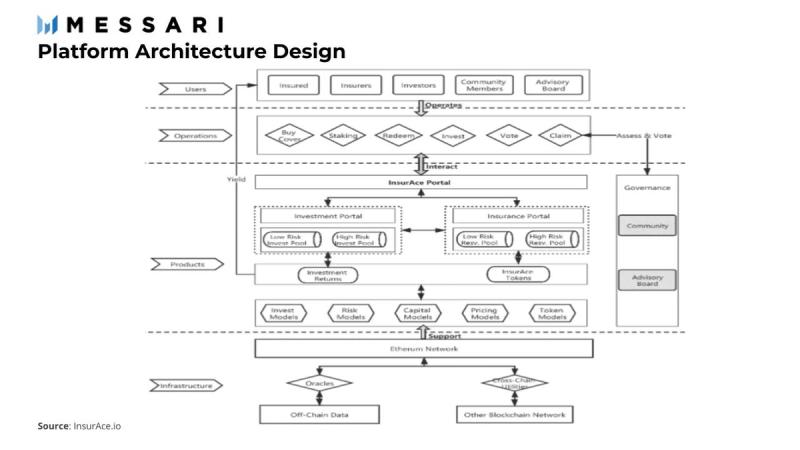

The platform design consists of four layers: the User Layer, Operation Layer, Products Layer, and Infrastructure Layer.

The User Layer includes investors, community members, advisory board members, insured, and the insurers who interact with the protocol.

The Operation Layer is where users participate by committing assets to capital pools, purchasing insurance coverage, or voting through governance.

The Products Layer is where insurance premiums are collected and become available to the capital pools and used for investment activity.

Lastly, the Ethereum network is the Infrastructure Layer. The network maintains interoperability with external price oracles and cross-chain utilities, and is used to confirm transactions on-chain.

INSUR Tokenomics

The INSUR token is an ERC-20 standard governance and utility token. It is used to incentivize participants through staking in various staking pools, voting on governance proposals, and taking a share of fees generated from the protocol. The INSUR token launched on mainnet to the Ethereum network in April 2021.

Staking

The InsurAce staking pools are vital to the health of the protocol because the capital in these pools secure the coverage offerings for the insured. Each staking pool has unique pool sizes and yields are adjusted based on demand. Users have the ability to stake a variety of tokens in either the underwriting pool or liquidity mining pools, in exchange for INSUR rewards. Between both pools, you can stake ETH, WETH, DAI, USDC, USDT, INSUR, mStable USD, and the Uniswap INSUR/USDC pair.

Users can stake and unstake assets at any time but will be subject to a 30 day lock-up period until they can be fully withdrawn. This ensures sufficient liquidity of the capital pools in the event of an eligible claim payout. Stakers will continue to earn rewards during this lock-up period.

Enhanced tokenomics will be released in Q2 2022 for V2. The team plans to replace existing INSUR token rewards with revenue-sharing arrangements, which will outsize current emission rates. Additionally, users who lock up INSUR tokens will receive veINSUR tokens, which will boost revenue sharing and governance power while offering discounts in purchasing cover.

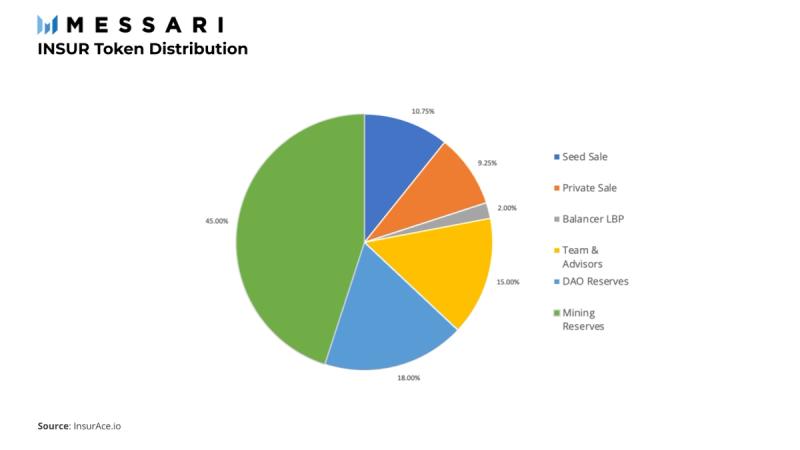

Token Distribution

The total supply of INSUR tokens are capped at 100 million tokens, which can be mined through staking on the protocol.

The Seed Round accounted for 10.75% of the token supply with a 15% unlock upon the token generation event (TGE). This allocation vests linearly over 2 years for the rest starting from the third month after the TGE.

The private sale was a strategic round that distributed 9.25% of the token supply with a 25% unlock upon TGE. This allocation vests linearly over 2 years for the rest starting from the third month after TGE.

The public sale on Balancer accounts for 2% of the token supply which were used as the initial liquidity bootstrapping effort

The Team and Advisors received a 15% token supply allocation, with a 5% unlock upon TGE. This allocation vests linearly over 2 years for the rest starting from the third month after TGE.

DAO Reserves were allocated 18% of the token supply which will be reserved for liquidity provisions on exchange listings, marketing initiatives, developer grants, bug bounty programs, and strategic partnerships.

The remaining 45% of the token supply is made available for Mining Reserves in accordance to the mining schedules.

Governance

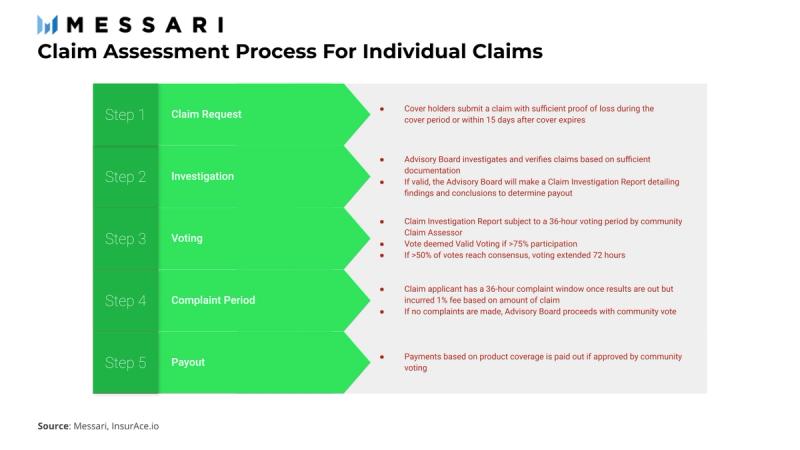

The governance function has yet to launch. Once it launches, the community will have the ability to vote on investments and changes in capital allocation, product listings and delistings, adding and removing features, protocol design improvements, and the Claim Assessment process. The DAO must complete a Claim Assessment, which is led by the Advisory Board and voted on by Claim Assessors.

Advisory Board

Determining the insurance claims legitimacy is the responsibility of the Advisory Board prior to moving forward to a community vote. Board members are whitelisted subject matter experts and are selected by the InsurAce team. The protocol will gradually move towards decentralized governance as the platform grows.

Claim Assessor

INSUR tokenholders can become a Claim Assessor by staking tokens in the underwriting mining pool or voting pools. Being a Claim Assessor gives you the ability to vote on claims and earn INSUR tokens as reward if your votes match the consensus.

The reward design does have risks as it can incentivize voters to make decisions based on the trend and not what’s in the best interest of the protocol. This could potentially put capital reserves and staker’s capital at risk. Users receive a voting ticket for every token staked (voting weight capped at 5% of total votes) and are only eligible to vote if they stake before each voting period.

Claim Assessment

The claims process is handled through the efforts of the Advisory Board and community through governance voting. The Claim Assessment Process includes Individual claims and Group claims, which require slightly different processes. An example of the individual claim process below:

Grants

InsurAce has been awarded several development grants from top Layer-1 protocols like Harmony, NEAR, Aurora, and Solana since they’ve launched. These ecosystem grant programs and treasury funds provide funding for projects they believe are a strong market fit and contribute to InsurAce’s mission and effort to go fully multichain.

Competition, Traction, and Roadmap

The competition among DeFi insurance protocols varies around product offerings, accessibility, and protocol design. InsurAce stands out by offering users portfolio-based cover, cross-chain coverage, and a differentiated protocol design.

Portfolio-based cover allows users to underwrite multiple product offerings in one transaction, reducing costs and saving time. InsurAce increases accessibility to a broader range of users by both eliminating KYC requirements and incorporating multichain coverage. Unlike its competitors, InsurAce functions similarly to a traditional insurance firm. This facilitates better risk management practices, capital efficiency, and improves utilization of reserved funds for strategic investments.

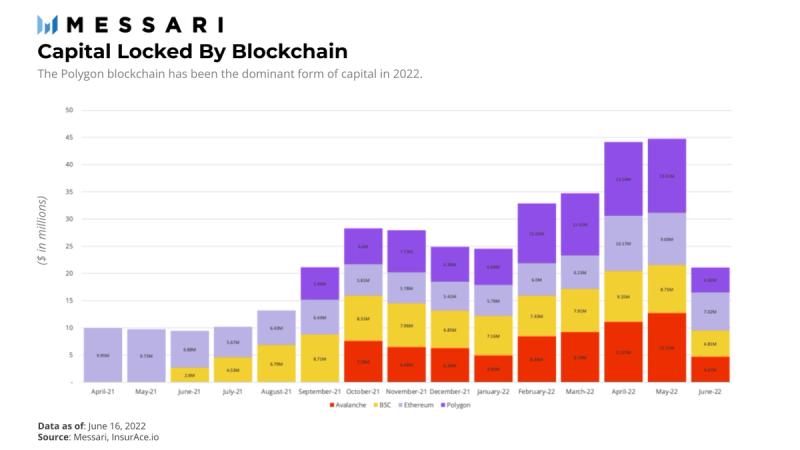

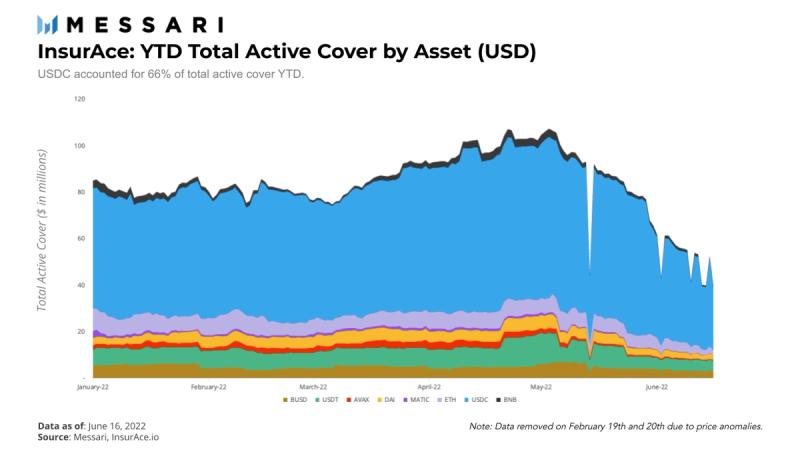

The InsurAce protocol sustained promising growth through the end of 2021 and into early 2022. Despite the cool down of crypto markets in Q1, InsurAce continued to lock in capital and saw a strong increase in demand for insurance coverage through the end of Q1 2022. The protocol has earned a cumulative premium amount of $1.9 million since inception.

Risks and Challenges

InsurAce is exposed to various risks primarily associated with smart contracts and staking. Oracle manipulation and smart contract bugs expose risks to the protocol and can cause a misprice of assets or even a loss of funds. When users stake assets, they are exposed to claims being paid out, potentially wiping out their total stake. Additionally, due to the staking lock-up period, stakers can miss out on the ability to deploy capital elsewhere. The InsurAce protocol has taken measures to reduce risk by going through smart contract audits by Slowmist and PeckShield. However, audits are not foolproof, and users should always be aware of risks mentioned above.

The need for DeFi insurance offerings becomes clearer with every hack or exploit the industry endures. However, DeFi insurance is a very small category representing a mere fraction of the broader crypto market. Limited liquidity and unpredictable investment options will present challenges to InsurAce. The lack of liquidity limits coverage options to a subset of users due to the lack of availability.

The flexible participation of liquidity providers can be a cause for concern when claims need to be paid out. If users initiate coverage for 90 days but stakers remove liquidity inside of 45 days, this could leave the insured exposed to the risks they were trying to mitigate.

In the current state of DeFi, there aren’t many reliable long-duration fixed income instruments similar to those found in traditional markets that could be held in the Investment Portal. When InsurAce’s Investment Portal launches, it will rely on sound and predictable investments to replicate the intended sustainable model of traditional insurance to reward users and optimize premiums.

Roadmap

The InsurAce.io protocol roadmap contains ambitious goals for 2022. It plans to double product listings from over 100 to over 200 and to grow the accumulative covered value from $300 million to $1 billion. It also plans to launch new insurance products and deploy on new chains.

Later this year, InsurAce will be delivering several new insurance product offerings: cross chain bridge insurance, NFT insurance, wallet insurance, and insurance for the metaverse. Aside from market volatility, the crypto economy continues to experience protocol breaches. With the recent devastating stablecoin de-peg event, it is more important than ever to have access to robust DeFi insurance products to protect users.

InsurAce V2

The first phase of InsurAce V2 released three new features on May 30, 2022. These upgrades included a Multi-Chain Insurance Aggregator, a Cover Cancellation Function, and Dynamic Pricing.

Multi-Chain Insurance Aggregator — The insurance aggregator will be an internal implementation to synchronize operations across multiple chains, enhance capital efficiency, and improve the user experience by having a chain-agnostic front end. This aggregator combines capital and capacity from all chains, increasing underwriting ability and capital efficiency. Claim voting is also improved through the elimination of bridging INSUR tokens across different chains, which was required in V1.

Cover Cancellation Function — The new V2 supports on-chain cover cancellation by refunding INSUR tokens and rewards to the user with unused premiums. This refund also reverses rewards issued to the referrer in the case of a referral code being used. When a cover cancellation is initiated, a cancellation fee of 10% of the unused premium will be applied to the insured.

Dynamic Pricing — Insurance cover pricing is determined based on the supply dynamic for any given cover. The pricing for the first 65% of the total coverage capacity for any cover will remain flat. The premium will increase, as the demand exceeds 65%.

Conclusion

As the InsurAce protocol clears its first year of operation, there is clearly a strong need for DeFi insurance products to protect digital assets. InsurAce improved on the shortcomings of first-generation insurance protocols by building a multichain platform, offering more flexible cover products, and embracing the free and open ethos of DeFi by eliminating KYC requirements. These features and the growing need for these products should help drive insurance adoption and bring better risk management options to all users across chains.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by InsurAce, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Last updated