A Valuation Model for Fei Protocol

Key Insights

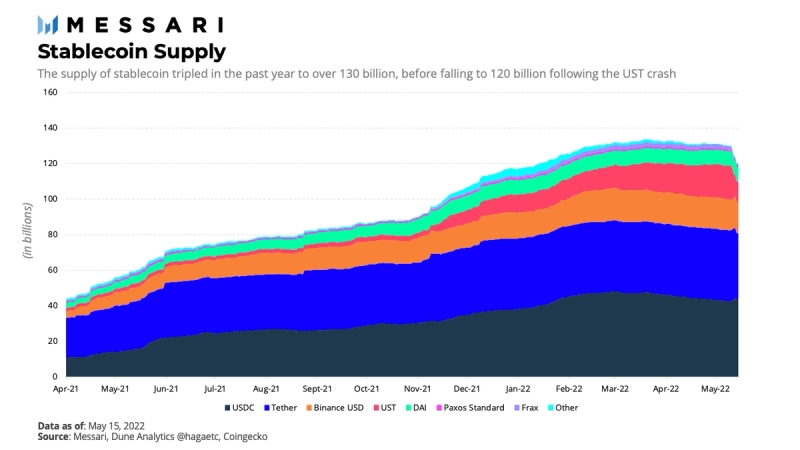

The stablecoin ecosystem has exploded in the past year with a threefold increase in supply to over 130 billion. USDT and USDC are the major centralized players, and UST (prior to the de-pegging event) and DAI are the largest decentralized stablecoins.

Fei Protocol is challenging the incumbents with its new reserve-backed stablecoin model. The protocol pioneered Protocol Controlled Value (PCV), owning the collateral it obtains for minting its stablecoin.

The USP of this model is that the collateral does more than just maintain the peg. By owning the collateral, Fei Protocol can deploy the PCV reserve to expand its ecosystem. Examples include providing Liquidity-as-a-Service to DAOs and earning yield.

With Fei V2, users can redeem FEI one-to-one for PCV reserves, and TRIBE holder incentives are aligned with the introduction of TRIBE buybacks and an emergency backstop.

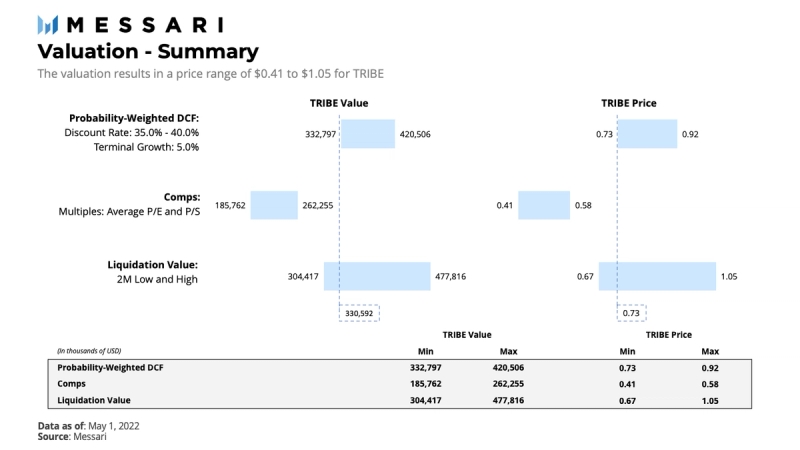

Our valuation model returns a price range of $0.41 to $1.05 for TRIBE. May 1, 2022, is taken as the valuation date to normalize for the abnormal market conditions following the UST de-peg.

Stablecoins play a linchpin role in the crypto ecosystem. The stable assets remove volatility, whilst safeguarding trustless transactions at near-instant settlement. These benefits have made tokens like USDT and DAI a ubiquitous part of the market.

However, most stablecoin models carry their own critical weaknesses:

Fiat-collateralized stablecoins like USDT and USDC are backed one-to-one by centralized entities. This centralization represents a large regulatory risk and has pushed users towards more transparent alternatives.

Crypto-collateralized stablecoins like DAI and LUSD are inherently capital inefficient. These stablecoins are minted when users take out loans overcollateralized with ETH and are hence restricted by the demand for debt.

Seigniorage stablecoins like ESD and Basis Cash over-rely on supply incentives. When the stablecoin trades below its peg, bonds are sold at a discount which can be redeemed for the stablecoin once the peg is recovered. This model creates an unfair distribution and has historically not been able to sustain the peg.

Fei Protocol seeks to provide a solution to these problems by pioneering Protocol Controlled Value (PCV). This feature allows Fei to take ownership of the collateral it receives for minting FEI. With the launch of Fei V2, the team believes it can now deliver on its vision of a highly scalable and fully decentralized stablecoin.

Fei Protocol - Overview

Founded in December 2020, Fei Protocol is a reserve-backed stablecoin that creates a tight peg to the US Dollar. The Fei team raised $19 million in March 2021 from Andreessen Horowitz, Framework Ventures, and Coinbase Ventures, among others, to fund its ambition of building a more capital-efficient decentralized stablecoin. At the time of writing, FEI records a $540 million market capitalization and a 30-day average daily trading volume of $11 million.

As indicated above, Fei Protocol introduced the concept of Protocol Controlled Value, which is a subset of Total Value Locked. Instead of allowing users to temporarily lock tokens in return for rewards, Fei Protocol takes actual ownership of the tokens. This allows the protocol to use the capital to pursue its objectives, such as maintaining stability in the peg, providing liquidity, and generating yield.

Before launch, FEI entered circulation via the sale of collateral along a bonding curve. In the first version of the protocol, the stablecoin could not be redeemed for its underlying collateral, making the PCV permanent. In addition, a combination of direct incentives and reweights were used to maintain the peg algorithmically.

Shortly after launch, the peg broke to an all-time-low of $0.71. This made the team realize that the peg mechanisms of the initial version were not sustainable and led to the introduction of Fei V2 in October 2021. The upgrade removes direct incentives and reweights. Furthermore, it will consist of two key pillars that Fei Protocol believes are essential:

Stability: FEI becomes redeemable one-to-one for PCV reserves. This allows Fei Protocol to scale and meet demand without compromise. Fei V2 initially sets a target reserve ratio of 100%. This means the PCV should at all times cover the user-controlled FEI. The target can be lowered through governance once the model is sufficiently tested, and if needed, new FEI can be minted to bring the ratio to 100%. The reserve ratio is also often referred to as the collateralization ratio. One-to-one redeemability has been live since the governance proposal was passed in September 2021.

Incentive Alignment: TRIBE holders become risk bearers and beneficiaries of PCV performance. When the protocol performs well, TRIBE holders are awarded part of the protocol equity in the form of TRIBE buybacks. Protocol equity is the amount of PCV that would remain if all user-circulating FEI were redeemed for PCV collateral. A TRIBE backstop is also implemented in case PCV underperforms. If the PCV falls below the target reserve ratio, TRIBE becomes mintable in exchange for FEI to defend the peg. These mechanisms align the incentives of TRIBE holders with the protocol.

Token Economics

Fei Protocol was launched as a DAO on day one and is controlled by TRIBE, the protocol’s governance token. While Fei Protocol does not require any active management by governance, the TRIBE holders can vote on several things:

Adjusting the allocation of PCV

Changing protocol parameters such as the target reserve ratio

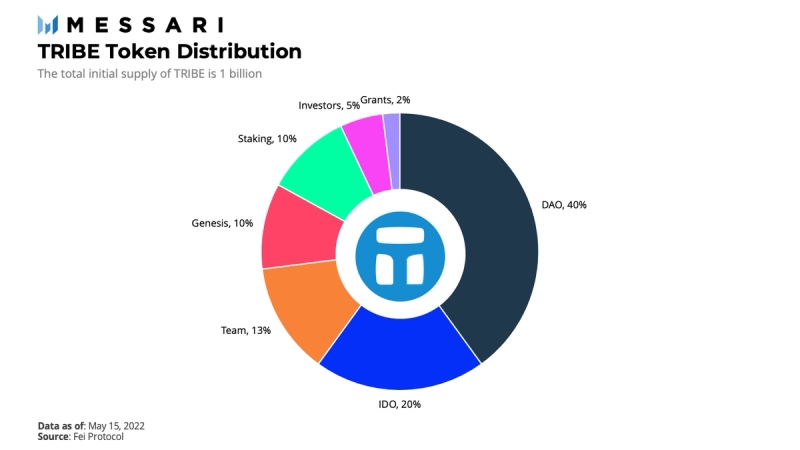

A total of 1 billion TRIBE tokens were distributed at genesis to the genesis group, community, core team, investors, staking rewards, grants, and DAO treasury. The community got access to TRIBE through the Initial DEX Offering held on Uniswap in April 2021. The investors and the core team are subject to a 4-year linear vesting and 5-year back-weighted vesting, respectively. The initial distribution is shown below.

Recent Upgrades

Besides the reserve-backed stablecoin, the protocol is also using its ecosystem to set up a service offering for DAOs. The most notable initiatives are as follows:

Liquidity-as-a-Service: Fei Protocol partnered with Ondo to offer Liquidity-as-a-Service for DAOs. Projects can deposit their token into an Ondo liquidity vault and Fei Protocol will match their deposit with an equal amount of FEI. These tokens are then deployed onto DEXs, essentially doubling the amount of liquidity for the project. When the service is concluded, the tokens are returned to the respective protocols, and Fei receives a fixed fee. The project keeps the trading fees and assumes any impermanent loss. This permits projects to get immediate liquidity on their token without any upfront capital.

Tribe Turbo: After the successful merger of Fei Protocol and Rari Capital, the two protocols have combined their offerings to set up Tribe Turbo. This service allows users to borrow newly issued FEI at 0% interest, collateralized with supported tokens. The borrowed FEI is then deployed into a Fuse pool of their preference. In return for the service, revenue is split with the Tribe DAO. The main benefit of this service is that DeFi tokens can become productive by taking out a costless line of credit and sharing in the yield generated. Tribe Turbo was launched in April 2022.

xTRIBE: TRIBE holders no longer have to decide between staking their TRIBE and participating in governance with the introduction of xTRIBE. Staked TRIBE will automatically be converted into xTRIBE which can be used for governance participation while TRIBE is locked. xTRIBE also supports auto-compounding and multi-delegation. The proposal for xTRIBE was launched on March 22, 2022. The team has yet to announce an expected time of arrival in case the proposal is successful.

Traction

Stablecoins witnessed a rapid acceleration in growth over the past year. Today, 120 billion stablecoins are supplied in the market. The total supply was reduced by over 10 billion following the UST collapse at the beginning of May. As per usual, we can see decentralized alternatives chip away market share from their centralized predecessors as they prove their technology and find market-product fit.

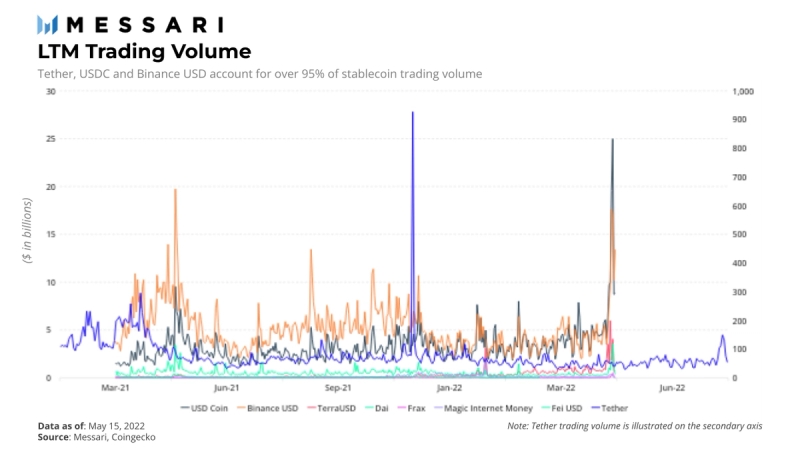

Over $50 billion in stablecoins is traded each day across CEXs and DEXs. Remarkably, the top three players account for more than 95% of the total volume. Tether tops the charts with over 85% of the trading volume to its name. Stablecoins have undeniably proven themselves as one of the “killer apps” in DeFi, and their prominence will only strengthen as the industry expands.

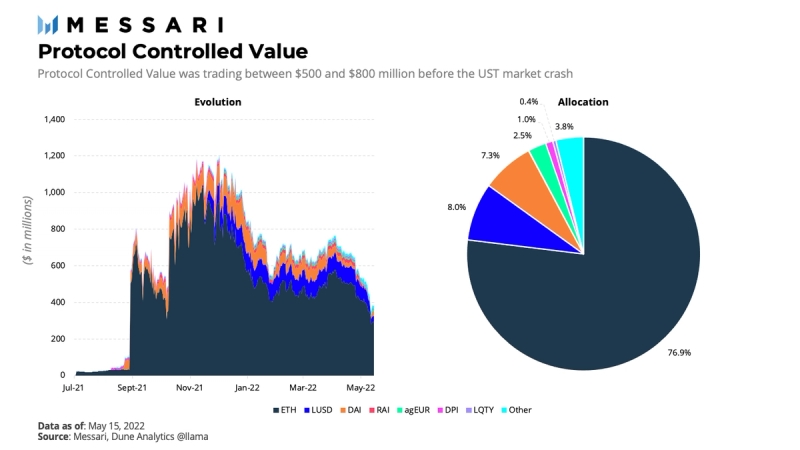

Fei Protocol’s balance sheet reflects how the stablecoin segment is thriving. Within half a year of its launch, PCV amounted to a staggering $1.2 billion. After this brief peak, PCV collapsed as a consequence of the poor market performance since November 2021. PCV has been trading in the $500–800 million range since the start of 2022. The reserve fell to a $350 million low this month after the UST market crash. The protocol has a large exposure to ETH and holds a variety of decentralized stablecoins. It also owns a small percentage of DeFi tokens such as CRV, CREAM, and COMP. The Tribe DAO has invariably expressed support for decentralized assets on its balance sheet.

Valuation Methodology

Fei Protocol generates cash flows from liquidity provision and yield generation on its Protocol Controlled Value and FEI. Since the protocol is governed by the Tribe DAO, these cash flows accrue to TRIBE holders through staking rewards and buybacks. While buybacks were temporarily paused following market volatility, we may assume that the DAO will proceed with buybacks or other value accrual mechanisms in the future.

These conditions allow us to value the token using traditional valuation methods. We believe a discounted cash flow analysis, a comparable analysis, and a liquidation value analysis are most suitable for this valuation. We take May 1, 2022, as the valuation date to exclude the abnormal market conditions following the UST de-peg.

Discounted Cash Flow

Discounted cash flow is a valuation method used to estimate the value of an asset based on its expected future cash flows. The rationale is that the value of an investment today must equal the money it generates in the future. For our model, we use a 10-year projection period and account for any cash flow thereafter with an estimated terminal value.

Assumptions

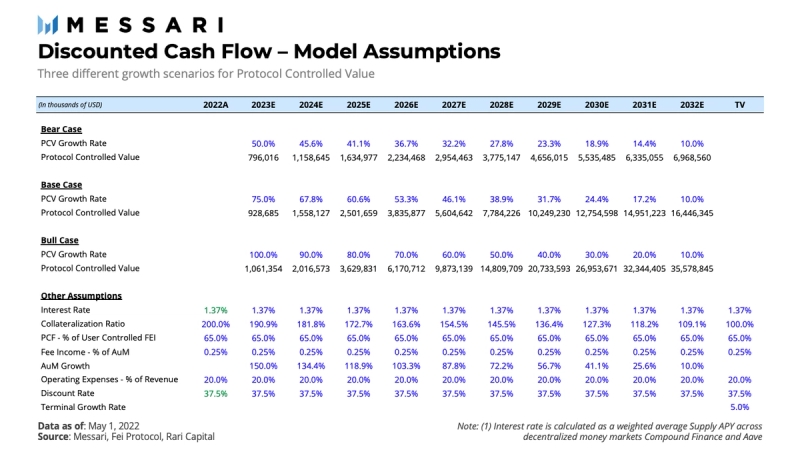

Our model is based on a number of key assumptions. These assumptions reflect our expectations of Fei Protocol and can be changed in our valuation model. You can find an overview of the model assumptions below, followed by a detailed explanation of each assumption.

Protocol Controlled Value

The growth of Protocol Controlled Value has a significant impact on the valuation as it drives the revenue the protocol can generate through liquidity provision and yield generation. PCV increases with the amount of interest earned, the appreciation of the controlled assets, and the net effect of FEI purchased and redeemed.

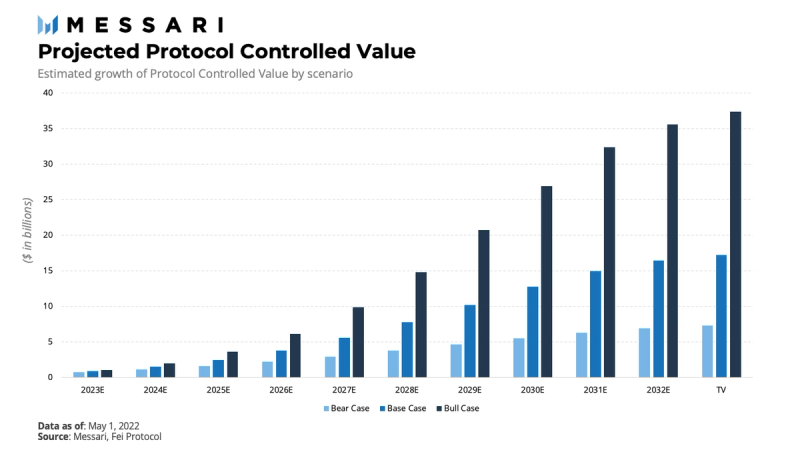

Given the significant amount of uncertainty, we select three different scenarios for PCV growth. The terminal rate is set at 5% for each case to allow us to perform scenario analysis and compute a probability-weighted valuation for TRIBE.

Bear case: PCV grows at an annual rate declining from 50% to 10%. This implies a slowdown of the DeFi market and/or Fei Protocol losing market share from its competitors.

Base case: PCV grows at an annual rate decreasing from 75% to 10%. The base case suggests that PCV will continue on its current trajectory and decrease from its annualized average growth of 78% as the project matures. This average is calculated from September 2021 to exclude the unusual growth at launch.

Bull case: PCV grows at an annual rate declining from 100% to 10%. To achieve these growth levels, Fei Protocol must benefit from an industry-wide expansion and establish itself as the leading decentralized stablecoin.

The projections for the three growth scenarios are illustrated below.

Protocol Controlled FEI

Besides Protocol Controlled Value, the protocol also holds FEI on its balance sheet. Similarly, Protocol Controlled FEI (PCF) can be used to provide liquidity and earn yield. To avoid overcomplicating the model, we compute PCF relative to PCV using the collateralization ratio.

As mentioned above, the collateralization ratio, or the amount of PCV over User-Controlled FEI (UCF), measures the amount users would receive if all UCF is redeemed for PCV pro-rata. The ratio has remained stable at around 200%, and we can expect the ratio to approach its target of 100% as the protocol scales. If we fix the amount of PCF over UCF to its current level of 65%, we can compute the amount of FEI controlled by the protocol.

Interest Rate

As we have seen, Fei Protocol generates revenue on its PCV and PCF. For the sake of simplicity, we assume that 100% of the balance sheet is used for yield generation in decentralized money markets. In reality, it is also deployed for liquidity provision and held as reserves.

To find an appropriate interest rate, we compute the average supply APY across money market protocols Compound Finance and Aave. We also include averages weighted to the size of the market to keep the numbers conservative. Finally, we set the interest rate at 1.37%. Our calculations can be found in the model.

Rari Capital

Because Fei Protocol merged with Rari Capital in December 2021, we must also take the fee income of the yield aggregator and money market into account. Rari Capital charges a 10% platform fee on the interest earned by Fuse depositors. The money market has earned $1.96 million in cumulative fees since its launch. This results in an annualized protocol revenue of $2.36 million.

Given the breadth of supported assets and unique pools, it is hard to reasonably estimate fees over the forecast period. We hence calculate the fee income as a percentage of Assets under Management (AuM) of the protocol. The AuM can also be regarded as the TVL. Modeling the fees in this manner is sensible since the amount of AuM is a key driver of fee generation. We set the ratio at 0.25%, the current level at a total value supplied of $944 million. We assume the AuM grows at an annual rate decreasing from 150% to 10%. This suggests the protocol will continue on its current trajectory and decrease from its average growth of 148% as the project develops. We calculate the average from mid-September 2021 to exclude the extraordinary growth in the startup phase.

Operating Expenses

The operating expenses must still be accounted for. These expenses may include marketing, payroll, research and development, and other expenses required to run the business.

We assume that the operating expenses amount to 20% of the total revenue. This is a common EBITDA margin for tech startups and can be used in this example as decentralized protocols are not subject to depreciation or interest expenses. Note that operating expenses are typically paid using token inflation. We forecast the expenses as a percentage of total revenue to avoid overcomplicating the model.

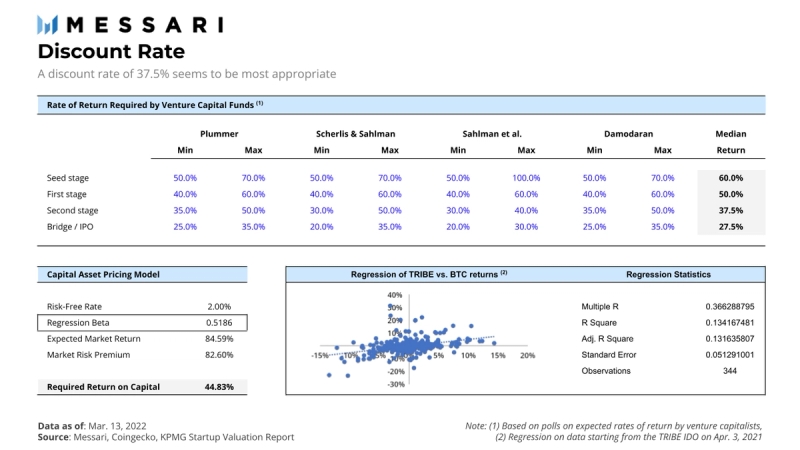

Discount Rate

Finally, the discount rate also has a significant impact on the valuation. Since we are analyzing a 10-month-old protocol, the return required by venture capital funds is a good gauge. The figure below illustrates the rates found in survey data from four reputable sources. Within the given categorization, Fei Protocol can be best described as a second stage startup, and, therefore, we believe 37.5% is the proper discount rate for the valuation.

As a cross-check, we also compute the discount rate using the Capital Asset Pricing Model. This model expresses the return expected by investors according to the amount of risk taken.

We use the 10-year Treasury note for the risk-free rate and BTC for the market benchmark. The beta is obtained by running a regression for TRIBE returns as a function of BTC returns. The regression is based on data starting from the TRIBE IDO on April 3, 2021. Consistently, we calculate the average BTC return over the same period for the expected market return. At last, the CAPM returns a cost of capital of 44.83%. Although the regression shows that BTC returns are significant in predicting TRIBE returns, only 13.16% of the total variance is explained by the model. Considering this, we cannot confidently rely on the CAPM discount rate and use the survey discount rate of 37.5%.

Valuation

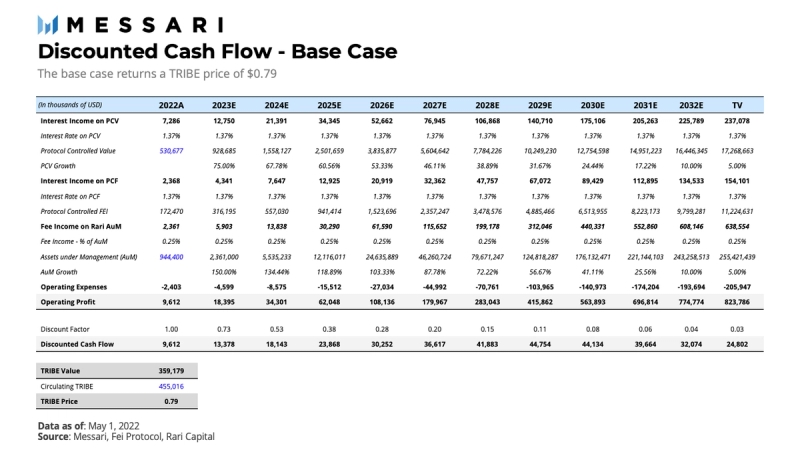

We now have all the required information to complete the discounted cash flow analysis. The result for the base case is illustrated below. For this scenario, we find a valuation of $359.2 million or $0.79 per TRIBE in circulation.

Probability-Weighted Valuation

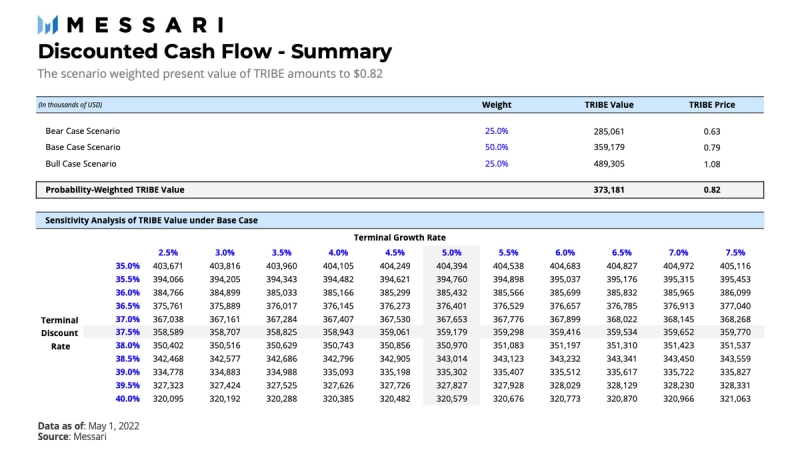

The final step of the analysis is to combine the results for the three scenarios. We assign a 50% probability to the base case and 25% to the optimistic and pessimistic case. In summary, we find that the discounted cash flow returns a range between $0.63 and $1.08 per TRIBE. The probability-weighted TRIBE price equals $0.82. This represents a potential upside of 197.6% at a current price of $0.28.

The sensitivity analysis shows that the model is much more sensitive to changes in the discount rate than the terminal growth rate. This is intuitive as the terminal value is discounted at a much larger discount factor than the other cash flows. In general, the largest restriction of the discounted cash flow is its overreliance on assumptions. It is thus recommended to also look at the implied valuation from peers.

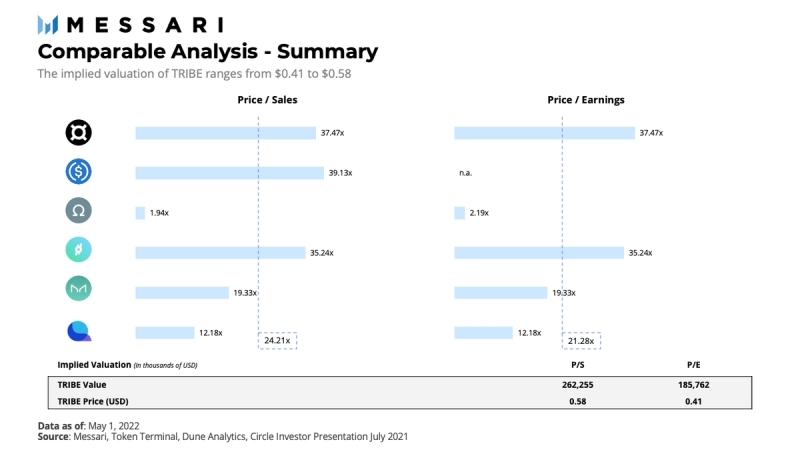

Comparable Analysis

Comparable analysis is a method used to value companies relative to their peers. The reasoning is that similar companies should have similar valuation multiples. For this valuation, we use the price-to-sales and price-to-earnings ratios. The limitation of this method is the availability of reliable sales figures in the crypto space.

Based on product and size, we select six comparable stablecoin projects:

Frax Protocol is a fractional-algorithmic stablecoin protocol. Under this model, the supply is partially backed by collateral and partially stabilized algorithmically. Similar to Fei Protocol, Frax uses a dual-token system. Frax is a close competitor of Fei Protocol.

USD Coin is the second-largest fiat-collateralized stablecoin after Tether. The stablecoin was launched in 2018 by a partnership between Circle and Coinbase. Fei Protocol wants to capture market share from USD Coin as a decentralized alternative.

Olympus DAO is a non-pegged stablecoin protocol. It achieves this by minting OHM when the value of OHM is greater than the value of the underlying treasury and burning when it is less. While FEI is pegged against the US Dollar, Olympus DAO remains a competitor for Fei Protocol.

Reflexer is a non-pegged stablecoin protocol backed by ETH. It introduces reflex-indices that are meant to be less volatile than their underlying assets. The protocol has an innovative design and is a competitor of Fei Protocol.

Maker DAO is the largest decentralized stablecoin protocol. Users can mint stablecoin Dai by taking out over-collateralized loans denominated in ETH. Fei Protocol seeks to become a better alternative to Maker DAO.

Liquity is another over-collateralized stablecoin protocol. Users can take out a loan denominated in the LUSD stablecoin against ETH collateral. The minimum collateralization ratio is set at 110%.

The two valuation multiples indicate that Fei Protocol may be undervalued as Fei Protocol trades below the average price-to-sales and price-to-earnings of 24.21x and 21.28x, respectively. All around, we find an implied valuation for TRIBE of $0.41 to $0.58.

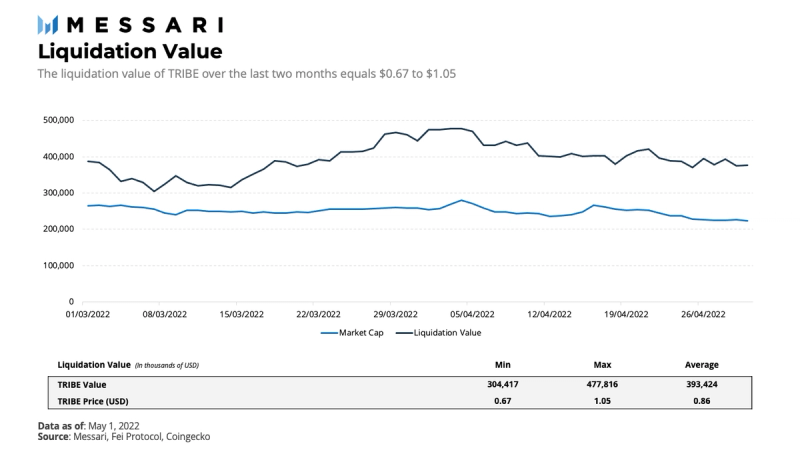

Liquidation Value

What makes Fei Protocol unique is that the protocol takes full control of the collateral it obtains for minting FEI. Since users can redeem FEI one-to-one for PCV reserves, we can determine the liquidation value of the TRIBE token by subtracting the user-circulating FEI from the PCV reserve. This amount is also called the protocol equity by the core team. It represents the claim TRIBE holders have if the Tribe DAO is wound up today.

Protocol equity traded at $363 million or $0.80 per TRIBE token on the valuation date. Given the volatility of the PCV reserve, we calculate the liquidation value over two months. We find a range of $0.67 to $1.05 in the past two months. The TRIBE token is consistently trading at a discount to its liquidation value.

Results

To conclude, we run a simple sensitivity analysis to obtain a range of valuation outcomes. For the probability-weighted discounted cash flow, we use a discount rate of 35.0% to obtain a maximum value. The minimum value is used by discounting the cash flows at a rate of 40.0%. The minimum and maximum values for the comparable analysis are found by using the P/E and P/S, respectively. We take the minimum and maximum protocol equity over the last two months for the liquidation value analysis. Finally, this returns a price range of $0.41 to $1.05 for TRIBE.

Risks

The following are some key risks Fei Protocol is facing:

Market risk: As several assets of the PCV are volatile, the protocol is exposed to market risk. Large movements in the underlying asset prices may cause the protocol to become overleveraged and force a TRIBE backstop. FEI may also lose its peg to the US Dollar if its stabilization mechanisms fail in adverse market conditions.

Competition risk: While Fei Protocol is challenging incumbents, the protocol is also facing mounting competition from algorithmic stablecoins. The competition will have a considerable impact on the growth of the protocol, and we have attempted to model this through the three growth scenarios.

Technology risk: The young project is prone to development risks as the protocol becomes battle-tested over time. We believe there to be low risk of a critical smart contract failure considering the positive smart contract audits.

Governance risk: The protocol is subject to governance-related risk as it is governed by the Tribe DAO. This may limit its ability to quickly enact changes, and it exposes the protocol to governance attacks. We believe this risk to be contained, as the DAO is designed to be governance-minimized. There is also a healthy balance between the active involvement of the core team and well-above-average participation rates on governance votes.

Conclusion

Fei Protocol is challenging the industry with its innovative Protocol Controlled Value model. The team is keen to learn from its initial obstacles and is executing improvements at incredible speed. Meanwhile, the protocol is finding product-market fit with Liquidity-as-a-Service and Tribe Turbo. Fei Protocol is also building out its ecosystem as a liquidity engine for DAOs by merging with yield aggregator Rari Capital. Whether all these initiatives will be enough to take on the incumbents remains to be seen. In any case, all three of the valuation methods show potential upside for TRIBE, and Fei Protocol undoubtedly has a lot in store for the stablecoin ecosystem.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Fei Protocol, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Last updated