Beefy Finance: Multichain Yield Optimizer

Key Insights

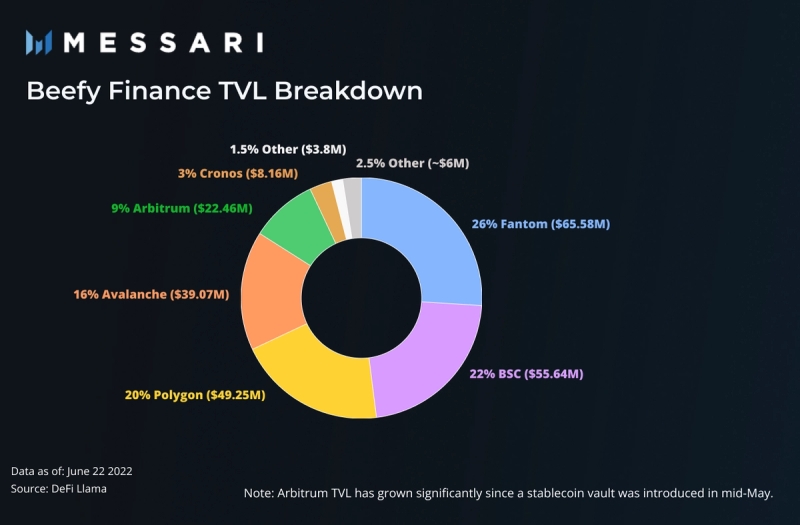

Beefy Finance is a multichain yield optimizer on BSC, Fantom, Polygon, Avalanche, and 11 other chains. To date, total value locked (TVL) is around $250 million across all of its chains

Beefy Finance’s most popular chains, Fantom, BSC, Polygon, and Avalanche, account for around 84% of the total $250 million TVL at $209.54 million.

Beefy Finance was built on BSC to reduce costly gas fees and expand its optimization strategies beyond its Ethereum-based competitor, Yearn Finance.

Beefy aims to optimize the annual percentage yield (APY) in its unique vault offerings/products.

Beefy’s mooVaults offer unique trading pairs that can only be found on its platform.

Data suggests the vast majority of BIFI token holders are long-term holders due to the token’s utility and attractive staking options.

Introduction

Yield farming is a popular method for earning passive income in decentralized finance (DeFi) markets. Yield farming refers to interest-earning market activities like liquidity providing, lending, borrowing, and staking. To optimize their yield, many users seek to auto-compound their interest. Auto-compounded interest removes the high costs and inconvenience associated with manually claiming and reinvesting interest. After the yield farming craze during 2020’s DeFi Summer, the industry looked to yield optimizers for more ways to make even more money efficiently.

Beefy Finance launched a couple months after DeFi Summer with the goal of taking yield optimization to a new level. The yield optimizer automatically reinvests earnings on compounded interest, and it maximizes yields using a variety of optimization functions for unique vaults (mooVaults).

Beefy’s mooVaults

Beefy Finance is a multichain yield optimizer deployed on 15 different chains. As a yield optimizer, Beefy offers a wide range of vaults where users can deposit their assets and automatically earn interest from their compounding interest in a process called auto-compounding. The protocol uses different metrics like APR, fees, and total value locked (TVL) to determine the best auto-compounding strategies, which vary for each vault. These strategies include a mix of liquidity provisioning, liquidity pools combinations, promotional coins from partnerships, and a variety of other yield farming strategies. For example, Beefy could take a pool’s APY and multiply it by adding a partner’s promotional coin into the vault, resulting in interest from the original assets in the vault and on the promotional coin. All of Beefy’s vault optimization functions and strategies are executed by immutable smart contracts, preventing any future code changes.

Beefy Finance offers three different vaults: 1) single-asset vaults, 2) stablecoin vaults, and 3) liquidity pool (LP) vaults. New vaults are regularly proposed on Beefy’s Discord channel. The proposed vaults must pass an internal audit by Beefy's strategists before they are offered on the platform. In addition, Beefy’s mooVaults offer many unique token pairs not available elsewhere.

LP Vaults

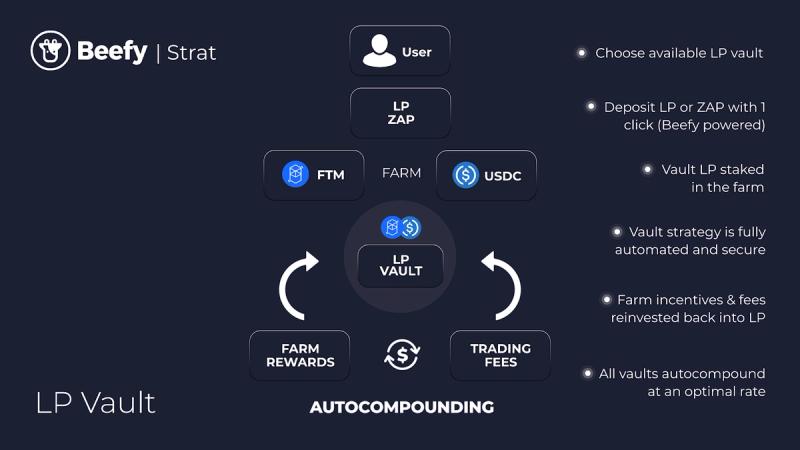

Beefy’s vaults are intuitive. The user can choose to deposit the LP token or provide a single asset and use Beefy’s ZAP feature. Beefy’s ZAP sells half of the single-asset deposit to purchase the other asset and create the token pair. This model is consistent with other yield optimization or aggregation platforms.

Source: Beefy Finance.

Single-Asset Lending Vault

Users staking in lending vaults will deposit one type of token into the vault. In the backend, the protocol borrows and lends the asset to increase capital and provide the highest possible yield. This strategy allows Beefy to discover the optimal auto-compounding rate.

BIFI Maxi Vault

BIFI is Beefy’s utility and governance token (explained more under BIFI Token). Staking BIFI entitles the staker to own a share of the earnings Beefy collects on its vaults. Beefy offers a special vault that allows BIFI holders to stake BIFI in a pool that offers an APY on the fee earnings generated from BIFI vaults. In other words, BIFI stakers would earn passive income from the fees Beefy generated from its vaults.

Launchpool

Beefy’s Launchpool promotes promising projects by featuring the projects’ tokens in special vaults that offer high APYs for partner tokens. These vaults allow the project partner to gain exposure through Beefy’s Cowmoonity, and they allow stakers to earn additional yields through promotional coins.

Partnership Vaults

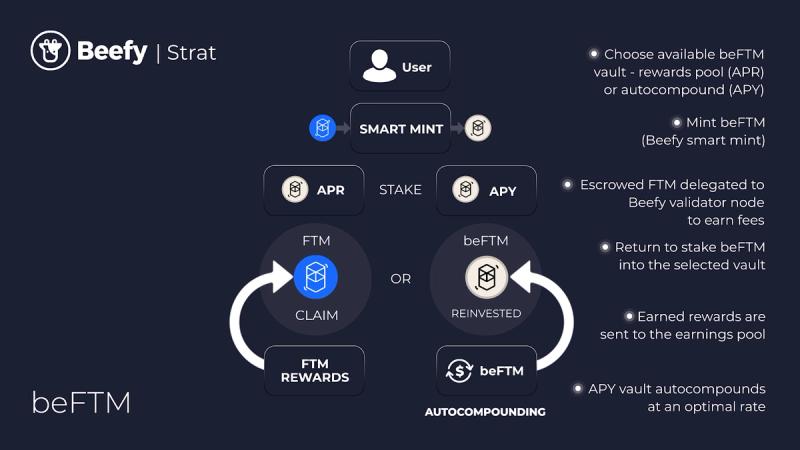

Beefy Escrowed Fantom (beFTM)

beFTM is a liquid staking FTM token pegged 1:1 with FTM. To mint beFTM, users deposit FTM into a Beefy Delegator Vault, which powers Beefy’s Validator Node. Users can deposit beFTM to earn APR on WFTM in the beFTM Earnings Pool. They can also stake beFTM in the beFTM vault to earn APY on beFTM.

Source: Beefy Finance.

binSPIRIT, beQI, and beJOE

Beefy has partnered with SPIRIT, Mai Finance, and Trader Joe to offer wrapped tokens for inSPIRIT, beQI, and beJOE, respectively. These wrapped tokens share the same benefits as the native tokens, including governance rights and a share of Beefy’s generated fees. Beefy allows its users to earn on APR and APY in the beJOE and beQI Earnings Pools.

BIFI Token

BIFI Utility: Staking

BIFI is a BEP-20 token where BIFI stakers are rewarded with a pro rata share of fees generated from mooVaults. A total of 67% of Beefy’s fees are distributed to BIFI stakers, which equates to around 3% of the harvest or auto-compounded interest. They can earn additional BIFI rewards by staking BIFI tokens in the governance token vault, BIFI Maxi Vault. These staking mechanisms help to minimize BIFI’s sell pressure.

BIFI Governance

BIFI holders have governance rights and can participate in making decisions in Beefy’s DAO. They can propose and vote on governance proposals or the creation of new vaults. BIFI holders that wish to submit a proposal must hold a minimum of 1 BIFI. Submitting a proposal on the platform is easy and only requires that the user write a title, description, and a link to the forum where discussions can be held. Most of Beefy’s governance proposals request funds, but many also introduce potential features. BIFI is a BEP-20 token native to BSC, but the vote.beefy.finance platform serves as a proposal creation and voting platform for decisions across multiple chains. Beefy implemented a custom Snapshot to support voting across multiple chains. Although the rights to create and vote on proposals are reserved for BIFI holders, anyone can contribute to the development of Beefy’s multichain ecosystem by participating in discussions on the protocol’s Discord or Telegram channels.

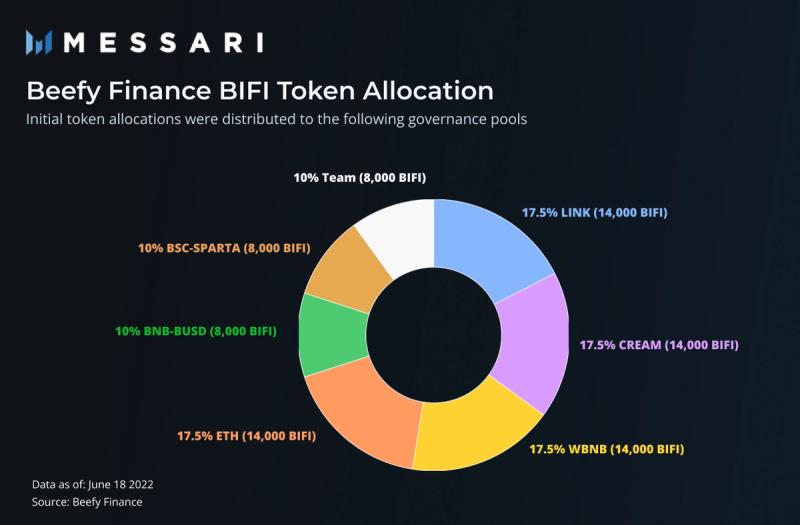

Tokenomics

BIFI has a total supply limit of 80,000 tokens, most of which are distributed to its initial governance pools: LINK (14,000 tokens), CREAM (14,000), WBNB (14,000), ETH (14,000), LP BSCSWAP with BNB-BUSD (8,000), and LP BSCWAP with BSC-SPARTA (8,000). Beefy strategically allocated BIFI to ensure sufficient liquidity in those strategic pools to support Beefy’s fundamental ecosystem. Beefy distributes 8,000 tokens to their team with OpenZeppelin’s TokenTimelock contract, which allocates 2,000 tokens to each of the four timelocks. The first Timelock was in October 2020, and the last Timelock will occur in July 2022.

Beefy’s fee distributions are allocated to the platform’s Cowmoonity, treasury, and vault strategies. More specifically, 3% of fees are allocated to BIFI stakers, 0.5% goes to Beefy’s treasury, 0.5% is used in vault strategies, and some percentage of other fees are awarded to network operators for Beefy’s platform.

Traction

The entire DeFi market, including Beefy Finance, has contracted since early 2022. However, Beefy has apparently picked up the traction from other protocols that failed in the first half of 2022. At the time of Anchor’s downfall, Beefy Finance introduced 12 new vaults, including a Curve stablecoin liquidity pool on Arbitrum with an APY as high as 35%. Beefy also announced new cross-chain capabilities with its integration with Oasis on May 14, 2022. Publicity around Beefy’s technical upgrades increased traction for the platform and pushed BIFI’s market cap from $32.73 million on May 15, 2022, to $55.28 million on May 17, 2022.

Beefy TVL

Beefy Finance’s most popular chains are Fantom, BSC, Polygon, and Avalanche. Together, these chains account for $209.54 million or 84% of the total TVL. Although the protocol was originally built for BSC, the majority of its traction (by TVL) comes from Fantom. Beefy’s strong traction on Fantom could be at least partially attributed to the success of its promotional vaults with Fantom’s FTM and Spirit Finance’s SPIRIT. Following Fantom and BSC, Beefy gains the most traction from Polygon and Avalanche. This traction was likely boosted by Beefy’s promotional vaults with Polygon native Mai Finance and Avalanche native Trader Joe. Recently, Beefy’s Arbitrum platform has been gaining traction from a stablecoin vault that debuted with almost a 35% APY on May 16, 2022. Significant traction from this vault and other stablecoin vaults triggered a 50% TVL increase on Arbitrum, going from $15.09 million TVL on May 15, 2022, to $22.72 million on June 22, 2022.

BIFI Traction

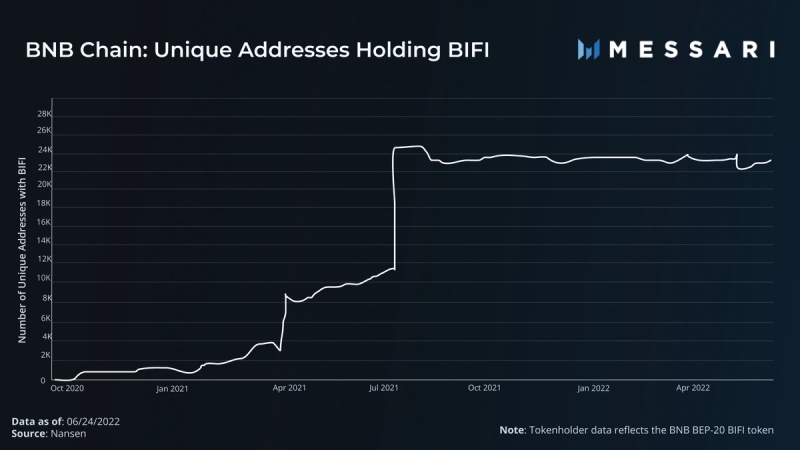

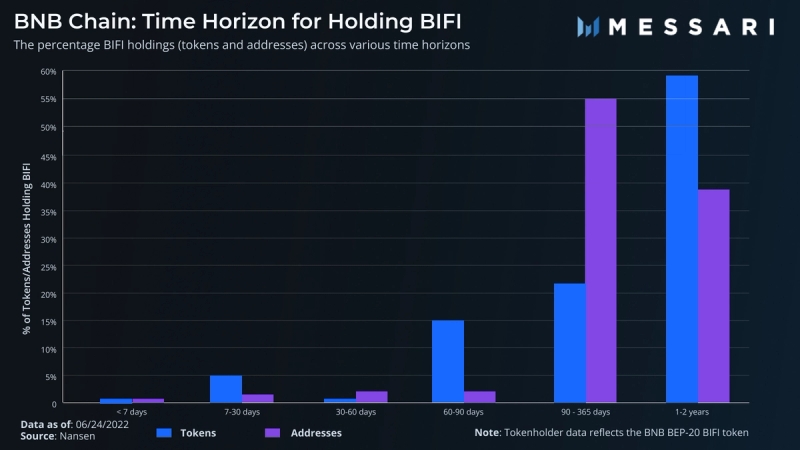

The majority of BIFI token holders are long-term investors. The graph below shows that 95% of addresses holding the BEP-20, BNB-based BIFI token have held the token for longer than 90 days, and around 39% of addresses holding the token have held it for at least one year. This indicates that BIFI is able to discourage selling pressure amid market downturns, and that there is real value in holding the token either for staking or governance.

The number of unique addresses holding the BEP-20 BIFI token on the BNB chain increased quite sharply in early April 2021. This number experienced steady growth until another sharp increase towards the end of summer 2021. Since then, the number of unique addresses holding BIFI has held constant, peaking at almost 24,000 unique addresses. The spikes in growth appear to correspond with governance updates and new vault offerings. On the BNB chain (corresponding to the BEP-20 BIFI token), the protocol did not grow its unique holders since early fall of 2021. On Fantom, Beefy's number of unique token holders increased substantially from 364 at the beginning of 2022 to 1,728 on June 20, 2022. On Avalanche, Beefy's number of unique token holders increased from 53 in September 2021 to around 500 in June 2022. On Polygon, Beefy experienced slow but steady growth from around 2,600 users in the beginning of 2022 to around 2,800 users in June 2022.

Competitive Landscape

Most protocols in this sector leverage their communities and offer yield maximizing strategies for average DeFi users. Beefy Finance differentiates itself from its peers by:

Offering unique token pairs and solutions that cannot be found on other yield farming protocols.

Developing an earnings-share model staking incentive that increase the organic value of its BIFI token. BIFI stakers receive 3% of Beefy’s harvest or auto-compounded interest, which then compounds and earns higher APY in BIFI’s Maxi Vaults.

Aggressively pursuing a cross-chain ecosystem and deploying on multiple chains at a faster rate than its peers. Beefy is deployed on 15 chains, with most of its TVL on Fantom, Polygon, BSC, and Avalanche. The protocol is also on up-and-coming chains that have gained some traction recently, like Arbitrum and Moonbeam.

Having the first-mover advantage of being the first yield optimizer to deploy on BSC, where gas fees are relatively low. Beefy’s first competitive advantage was being built on BSC because it allowed the protocol to explore yield optimization strategies beyond simply minimizing gas fees. Beefy also launched when BSC became increasingly popular and gained (and retained) significant traction during the Layer-1’s rise to popularity.

Other yield optimizers have competitive advantages that Beefy may benefit from. For example, many yield optimization platforms also offer leveraged yield farming, where users earn more interest by borrowing and farming more collateral. These platforms are highly attractive for the amount of yield that users can earn. However, they are also catered towards an audience with a relatively higher risk tolerance. Beefy does not offer leveraged yield farming solutions. However, leveraged yield farming could be an attractive addition to Beefy’s ecosystem and a tool to engage new users.

There are also yield optimizer platforms that provide more tailored services either in a specific sector or for a unique service. For example, GRO protocol offers leveraged yield farming with a risk tranching mechanism that allows users target specific risk levels. PancakeBunny is another example of a tailored service as the protocol only aggregates yield and auto-compounds yield for PancakeSwap LP pairs. Beefy Finance maintains a strong lead (by TVL) in the yield optimization sector, which indicates that the platform doesn’t need to cater to a specific niche. However, adding niche and unique features on the platform could engage new audiences.

Risks

Mitigating Risks on Beefy

Common risks from yield farming include impermanent loss, smart contract risk, liquidation risk, and the risk of unexpected prices for gas fees. But as an automated yield optimization tool, Beefy Finance mitigates these risks through several features. Users can avoid the risk of overpaying gas fees by using Beefy instead of reinvesting compounded interest with a series of manual transactions. Beefy also rolled out an Allowance Checker feature that lets its users give allowances or impose restrictions on where their tokens are allocated. The feature empowers users with greater risk mitigation tools.

Contagion Risk

Beefy can benefit from new users leaving previous protocols to use Beefy. However, Beefy’s vaults rely on how various partnered protocols perform. The failures of Beefy partners, particularly those with promotional coins in mooVaults, could result in significant losses for Beefy users. However, because Beefy offers a wide range of mooVaults, only a small percentage of mooVaults are likely to fail at any given time. Concentration risk may arise when Beefy only offers a limited range of mooVaults at one time or if many of the mooVaults leverage the same assets/projects. Beefy also released specific guidelines (Beefy SAFU Practices) for governing which projects are accepted in their Launchpool program. While the protocol does not guarantee the solvency of any Launchpool project, they do perform due diligence to ensure none of the accepted projects are rug pulls.

Roadmap

Beefy Finance will continue to offer new vaults and develop novel strategies to optimize yield in 2022. The platform expects to deploy on Optimism next month and is working to expand its multichain ecosystem to Kava and more in the future. Beefy’s team continues to monitor the security of its smart contracts by working with smart contract auditing firms like OpenZeppelin.

Conclusion

According to TVL, Beefy Finance has gained strong traction and has earned a dominant lead in the cross-chain yield optimization and aggregation sector. Beefy’s BIFI tokens could be considered long-term investments, fueled by Beefy’s fee royalties model and staking incentives. The protocol has demonstrated its ability to leverage partnerships with other projects on multiple chains to promote cross-chain adoption. While the yield aggregator is exposed to contagion risks, the risks are mitigated by the diversity of Beefy mooVaults. Beefy has managed to sustain consistent traction despite market downturns, and it is now poised to expand with the introduction of new vaults and optimization strategies.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by the Beefy Finance, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Last updated